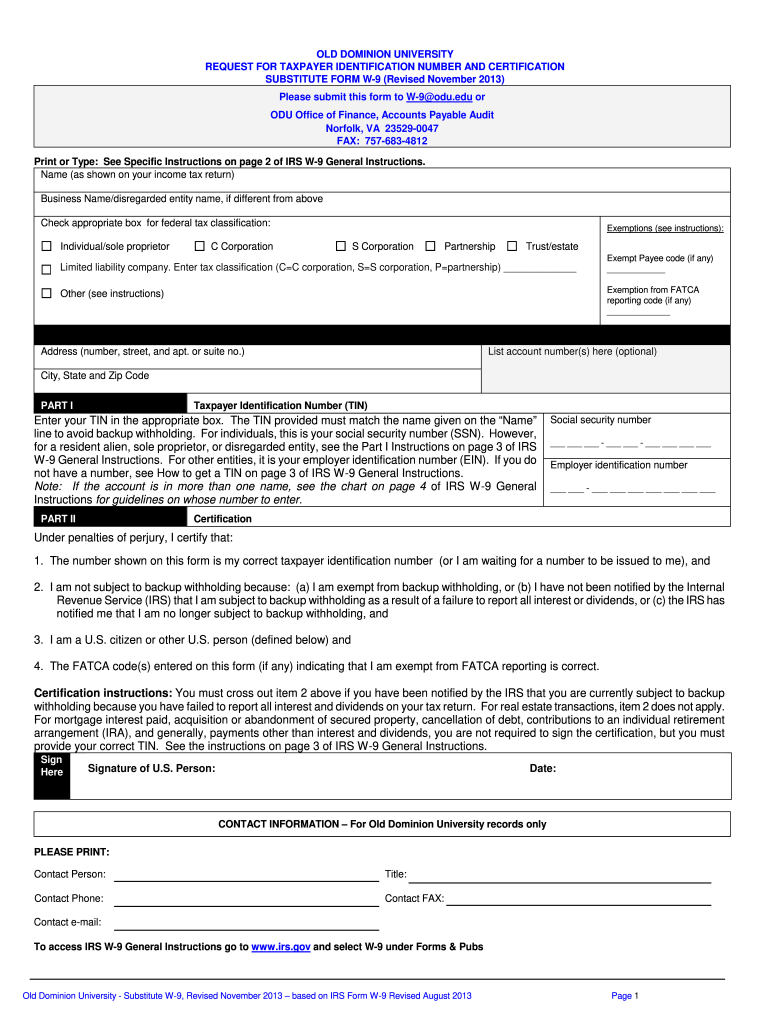

Old Dominion University Substitute W-9 2013-2025 free printable template

Get, Create, Make and Sign blank w9 form

Editing w 9 fillable online

How to fill out trial blank w9 form

How to fill out Old Dominion University Substitute W-9

Who needs Old Dominion University Substitute W-9?

Video instructions and help with filling out and completing fill out w9 2024

Instructions and Help about what is form w 9

Hey there the next few minutes I want to show you how to fill out an IRS form called the w9 kind of strange sounding form, but really this is a form that gets used for all kinds of different purposes, and it's probably going to come up at some point in the life of your real estate investing business sometimes you're going to have to fill this out on behalf of yourself, and sometimes you're going to have to request that somebody else fill out this form for you and really the whole purpose of this form is pretty simple it's just so that one party can get the information they need from the other party in order to file a specific form with IRS so for example one of our property is being bought or sold and the closer needs to file a form called a 1099 s in order to get that information they could get it from this form if it's filled out and signed and dated by the appropriate party or for example if you as the seller on a seller finance deal you need to send out what's called a 1098 form to the borrower you could also get that information from this as well and those are just two examples there's a slew of other reasons why this form could be helpful, but really I just want to show you how to fill this form out whether you're filling it out on behalf of yourself or whether you're filling it out on behalf of somebody else and you're trying to get their signature you would really just have to put all the information that you know right here in this form and right now I'm showing you the online version from the IRS website and keep in mind this form actually it changes and gets updated every so often you'll see right here at the top where it says revised December 2014 at some point in the future I guarantee this is going to be revised again so whenever you're filling this out just make sure you're working with the current copy because there are these little minor changes that happen every so often and really all you have to do is just enter in all the information you have about the person from whom this form is being requested so for example if this form was being requested from me, I would just go ahead and put my information in here like this and depending on whether you're filling this out on behalf of yourself or on behalf of a business entity that's when you would fill in this second line here so for example if I was filling this out on behalf of my business entity I would just put my company name in here and then when you look at this second line right here in my case I have what's called a single-member LLC which in this form the IRS essentially treats the same as a sole proprietorship if you're just operating on behalf of yourself, so I would check this box right here and then once that's done I would go over here none of this stuff applies to me somebody's leave that blank and I would put in my business address here and if I'm filling this out on behalf of somebody else and I would either leave this part blank or this section would already be...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get printable w 9 form blank?

How do I edit w9 forms 2020 printable online?

Can I create an electronic signature for the blank w 9 form 2020 in Chrome?

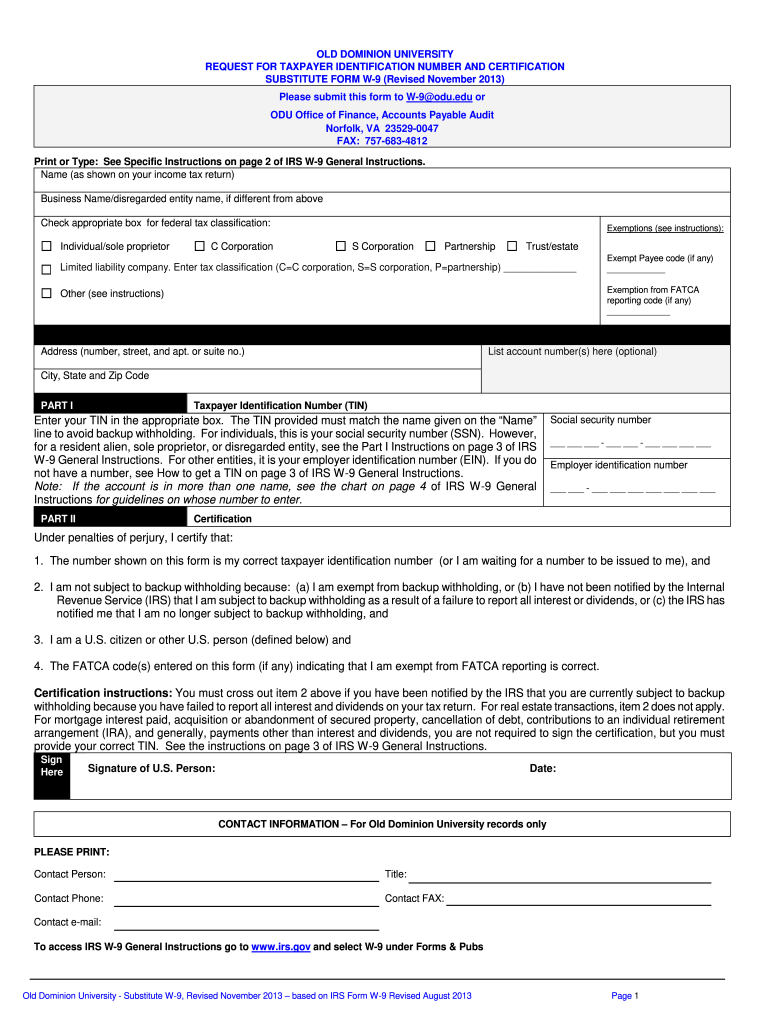

What is Old Dominion University Substitute W-9?

Who is required to file Old Dominion University Substitute W-9?

How to fill out Old Dominion University Substitute W-9?

What is the purpose of Old Dominion University Substitute W-9?

What information must be reported on Old Dominion University Substitute W-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.